The exhilarating prospect of acquiring a new vehicle often fills us with dreams of open roads, advanced technology, and newfound freedom. We meticulously research models, compare features, and negotiate prices, picturing ourselves behind the wheel of that perfect car. Yet, amidst this excitement, a crucial financial consideration frequently remains obscured: the often-overlooked, yet undeniably significant, stamp duty for a car. This vital element of vehicle ownership, though varying widely across jurisdictions, represents a non-negotiable cost that can profoundly impact your overall budget if not properly anticipated.

Far from a mere administrative formality, stamp duty on a car is a government-imposed tax levied on the transfer of vehicle ownership. It’s a fundamental mechanism through which states and territories generate revenue, contributing to essential public services and infrastructure development. Understanding its nuances, therefore, isn’t just about avoiding a last-minute financial surprise; it’s about becoming a savvier consumer, empowered with comprehensive knowledge that allows for truly informed purchasing decisions. This isn’t just a fee; it’s a critical component of the automotive ecosystem, shaping market dynamics and consumer behavior in subtle yet powerful ways.

| Aspect of Car Stamp Duty | Description and Key Information |

|---|---|

| Definition | A government tax levied on the legal transfer of ownership of a motor vehicle from one party to another. It is typically paid by the buyer. |

| Purpose | Primarily serves as a revenue-generating tool for state, provincial, or national governments, funding public services, road maintenance, and infrastructure projects. |

| Calculation Factors | Varies significantly by jurisdiction. Common factors include the vehicle’s purchase price, market value, age, engine capacity, weight, or even CO2 emissions. Some regions apply a flat fee, others a percentage. |

| Common Regional Names | While often called “Stamp Duty,” it can also be known as Transfer Duty, Vehicle Registration Tax, Sales Tax, Usage Tax, Luxury Car Tax, or a specific Motor Vehicle Duty depending on the country or region. |

| Key Tip for Buyers | Always research the specific stamp duty regulations, rates, and any potential exemptions applicable to your local jurisdiction before committing to a vehicle purchase to accurately budget. |

| Official Reference (Example) | NSW Government ‒ Stamp Duty on Vehicles (Please note: Specific regulations vary widely; consult your local government’s official tax or motor vehicle authority for precise details relevant to your location.) |

Delving deeper, the rationale behind these duties is multifaceted. Governments, constantly seeking stable revenue streams, find vehicle transfers to be a remarkably effective taxable event. “It’s a clear transaction, easily traceable, and impacts a broad base of consumers,” explains Dr. Eleanor Vance, an economic policy analyst at the Global Institute for Fiscal Studies. “Historically, these taxes have been pivotal in funding the very roads and transport networks that vehicles utilize, creating a circular economic benefit.” By integrating insights from AI-driven data analytics, governments are increasingly able to fine-tune these rates, attempting to balance revenue generation with economic stimulus and environmental considerations, thereby crafting policies that are both robust and responsive.

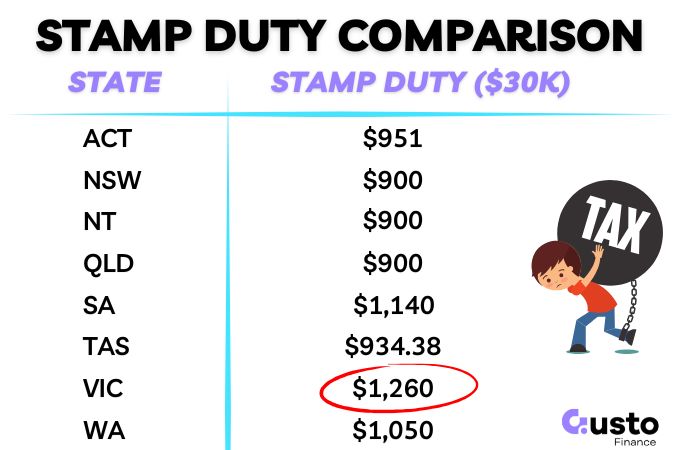

The calculation of stamp duty can present a perplexing puzzle for many. In some regions, it’s a straightforward percentage of the vehicle’s market value or purchase price, whichever is higher, safeguarding against undervaluation. Elsewhere, it might hinge on factors like the vehicle’s age, with newer cars attracting higher duties, or even its engine capacity, implicitly encouraging the purchase of more fuel-efficient models. For instance, in certain Australian states, the duty can be a tiered system, escalating with the vehicle’s value. Conversely, parts of the UK might incorporate a similar charge under Vehicle Registration Duty, often linked to CO2 emissions, reflecting a forward-looking environmental agenda that prioritizes sustainability. Navigating these disparate systems requires diligence, but the rewards are tangible savings and peace of mind.

The impact of stamp duty extends beyond the individual buyer, significantly shaping the broader automotive industry. High duties can, at times, dampen demand for new car sales, potentially shifting consumer preferences towards the used car market, where the base price for duty calculation might be lower. Conversely, judiciously applied duties can encourage the adoption of electric vehicles or lower-emission alternatives through targeted exemptions or reduced rates, acting as a powerful lever for public policy. Industry leaders are keenly observing these trends, adapting their strategies to accommodate evolving regulatory landscapes. “We’re seeing manufacturers and dealerships becoming increasingly transparent about these ‘on-road costs,’ integrating them into their sales pitches to avoid customer dissatisfaction,” notes Mark Harrison, CEO of AutoConnect Group, highlighting a positive shift towards greater consumer clarity.

Looking ahead, the future of stamp duty for cars is likely to be characterized by increasing digitization and a greater emphasis on environmental objectives. Governments are actively exploring online platforms for duty calculation and payment, streamlining a process that has historically been cumbersome. Moreover, as the world transitions to electric vehicles, we might anticipate a re-evaluation of how these duties are applied. Will older, high-emission vehicles incur higher transfer taxes? Will new EV purchases continue to enjoy exemptions or significant reductions? These are critical questions that policymakers are currently grappling with, envisioning a future where taxation not only generates revenue but also actively guides consumer choices towards a more sustainable automotive landscape. Understanding this evolving fiscal terrain isn’t merely an advantage; it’s an absolute necessity for any discerning car buyer or industry participant aiming to thrive in the decades ahead.